October 30, 2024, 10:34 PM UTC

Canary Capital has officially entered the competition to launch a Solana exchange-traded fund (ETF), filing for SEC approval on October 30, 2024. This move comes as more investors seek cryptocurrency-backed investment options.

The new ETF, called the Canary Solana ETF, aims to give investors exposure to the price of Solana (SOL) through a trust. However, the filing did not mention a custodian or administrator.

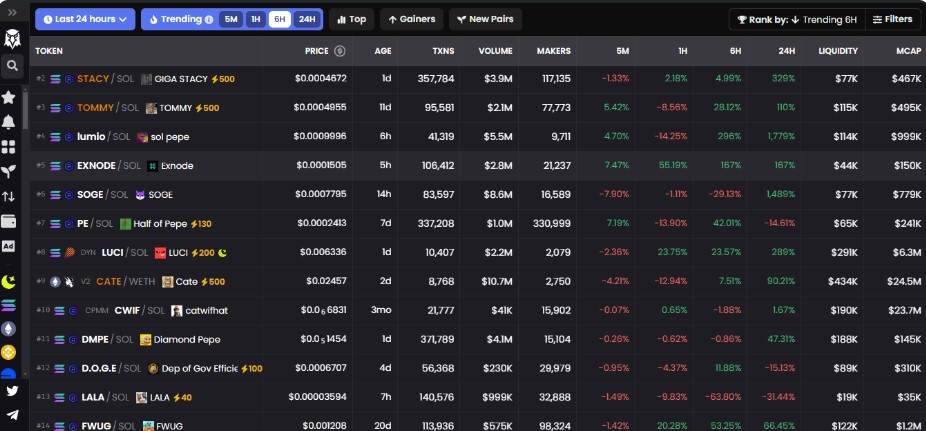

In its registration, Canary Capital highlighted Solana’s strong decentralized finance (DeFi) metrics, such as high transaction volumes, a growing number of active addresses, and low transaction fees.

Founded by Steven McClurg, who also started Valkyrie Funds, Canary Capital has been expanding its ETF applications. Recently, the firm also filed for spot ETFs focusing on Litecoin and XRP.

Canary’s efforts follow a similar move by VanEck, which filed for a Solana ETF in June. At that time, VanEck’s head of digital asset research, Matthew Sigel, suggested that Solana could be viewed as a commodity, similar to Bitcoin and Ethereum. This view contrasts with the SEC’s classification of Solana as a security in its regulatory actions against Binance.

Earlier this year, the SEC approved several spot Bitcoin ETFs and later Ethereum ETFs, raising speculation about the potential approval of more cryptocurrency-backed ETFs, including those related to Solana.

Canary Capital’s latest move highlights a growing trend among investment firms looking for regulatory approval in the expanding crypto ETF market, as they await further decisions from the SEC.